A 2025 report named Birmingham as the UK city with the highest number of people searching for “mould removal” (about 510 searches/month), a proxy indicator of prevalent damp, moisture and potential structural-defect issues.

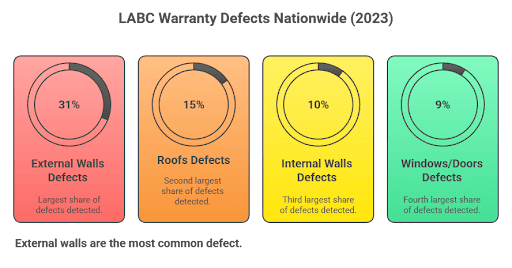

According to a surveying/inspector-provider LABC Warranty (2023), of all defects detected nationwide, the largest share ( 31%) involved external walls, followed by roofs ( 15%), internal walls (10%), windows/doors ( 9%), and gradually smaller shares for floors, drainage, foundations, etc.

Securing the right structural warranty is one of the most important steps when planning a new build in Birmingham. Whether you are a homeowner, developer or self-builder, this warranty offers critical protection against future defects and plays a key role in financing and resale. With Birmingham seeing steady growth in both residential and commercial development, the need for quality cover has never been more essential.

Understanding Structural Warranties

Before committing to a build, it is vital to understand what a structural warranty includes and why it matters for long-term security.

What a Structural Warranty Covers

A structural warranty is a specialist insurance policy that protects against significant defects in the design, materials or workmanship of a newly built property. It typically covers key structural elements such as foundations, load-bearing walls, floor slabs and roofs. Most policies last for 10 years from the date of practical completion, making it commonly referred to as a 10 year builder warranty or 10 year building warranty. This ensures any major defects that appear during this period are resolved without unexpected cost to the property owner.

Why Structural Cover Matters for New Builds

Mortgage lenders often insist on a structural warranty before approving funding for a new build or converted home. Without it, securing finance or selling the property can become difficult. A new home warranty also reassures buyers and investors that the build has met recognised standards and is protected against hidden defects. This peace of mind extends beyond the initial construction, offering long-term value and easier resale.

Choosing a Structural Warranty Provider in Birmingham

With many warranty providers operating across the UK, selecting the right one for a project in Birmingham requires careful consideration.

Approved and Recognised Providers

Choosing a warranty backed by a provider accepted by major mortgage lenders is crucial. Many lenders refer to the UK Finance approved list, which includes insurers with proven financial strength and reliable claims handling. Without this recognition, a warranty may fail to meet lending criteria or create difficulties later on during resale.

Key Features to Look For

Before selecting a policy, it is important to assess the scope of cover, claims procedures and financial backing of the insurer. The ideal warranty should offer clear protection for the full 10-year term, with minimal exclusions and a straightforward claims process. Providers should also be financially stable and regulated by the Financial Conduct Authority, ensuring long-term reliability.

How Local Expertise Adds Value

Working with Birmingham-based surveyors or warranty providers can offer distinct advantages. Local experts are familiar with regional building control standards, common construction challenges and soil conditions such as those found in areas prone to subsidence or poor drainage. This insight helps ensure accurate risk assessments and smoother policy implementation.

Structural Warranties for Developers and Homeowners

The benefits of a structural warranty extend to all parties involved in a property’s construction and future sale.

Developer Benefits

For developers, a structural warranty reduces future liability and risk exposure. It also enables easier access to funding by satisfying lender requirements and enhances buyer confidence by demonstrating a professional, regulated build process. Offering a 10 year building warranty can also help developments stand out in a competitive market.

Homeowner Protection

For homeowners purchasing a newly built property, a new home warranty offers essential reassurance. If a major defect appears within the warranty period, the policy covers the cost of investigation and repair, saving thousands in unexpected bills. This protection supports overall construction quality and removes the risk of relying solely on the original builder’s guarantee.

Costs and Coverage Explained

Understanding the cost structure and what affects pricing is a vital step before purchasing any warranty.

Average Costs in Birmingham

The cost of a structural warranty varies based on several factors including property value, design complexity and the developer’s track record. In Birmingham, prices are generally aligned with national averages, although higher-risk builds or unusual materials may attract higher premiums. Insurers also consider the development location, as ground risk or historical planning issues may influence pricing.

Comparing Quotes

Getting multiple quotes is a smart way to find the best deal without compromising on cover. Comparing building warranty options from different insurers allows developers and homeowners to assess the full value of each policy, including what is covered, how claims are handled and how excesses apply. At Buildsafe, we streamline this process by helping you compare structural warranty quotes from multiple approved providers to find the most cost-effective cover without compromising on protection.

How to Get a Structural Warranty in Birmingham

Arranging a structural warranty is a straightforward process, but timing is key.

The Application Process

Most providers require submission of project plans, drawings and risk information before construction begins. The process typically includes a technical audit or site inspection followed by underwriter assessment. Once approved, a policy is issued covering the full warranty term. Some insurers may also carry out periodic inspections during construction to monitor build quality.

When to Arrange Cover

It is strongly recommended to secure a structural warranty before any construction work starts. Delaying the process may limit available options or result in higher costs due to retrospective inspections or increased perceived risk. Early engagement ensures better terms and helps avoid delays in obtaining funding or sign-off.

Local Insight: Birmingham’s Building Trends

The property landscape in Birmingham is evolving rapidly, increasing the importance of reliable warranties.

Growth in New Housing Developments

Birmingham continues to experience high demand for housing through regeneration schemes, student accommodation and suburban expansion. As new developments emerge, structural warranties remain important in maintaining quality and supporting buyer trust in off-plan sales.

Common Structural Risks in the Region

Ground movement and drainage issues are common in parts of Birmingham due to local soil types and older infrastructure. A comprehensive structural warranty helps mitigate the financial impact of these risks by ensuring major repairs are covered within the policy period. Awareness of these regional challenges reinforces the value of having a well-structured warranty in place.

Peace of Mind for Every Build

On top of being a legal or financial requirement, a structural warranty is a vital tool for ensuring long-term value and quality in new construction. Having the right protection in place safeguards your investment for years to come.

Speak to Buildsafe today to secure your structural warranty in Birmingham and get expert help comparing cover across multiple providers.