Latent Defects Insurance

Buildsafe Construction Insurance

Save up to 30% with our Construction Insurance

Latent Defects Insurance

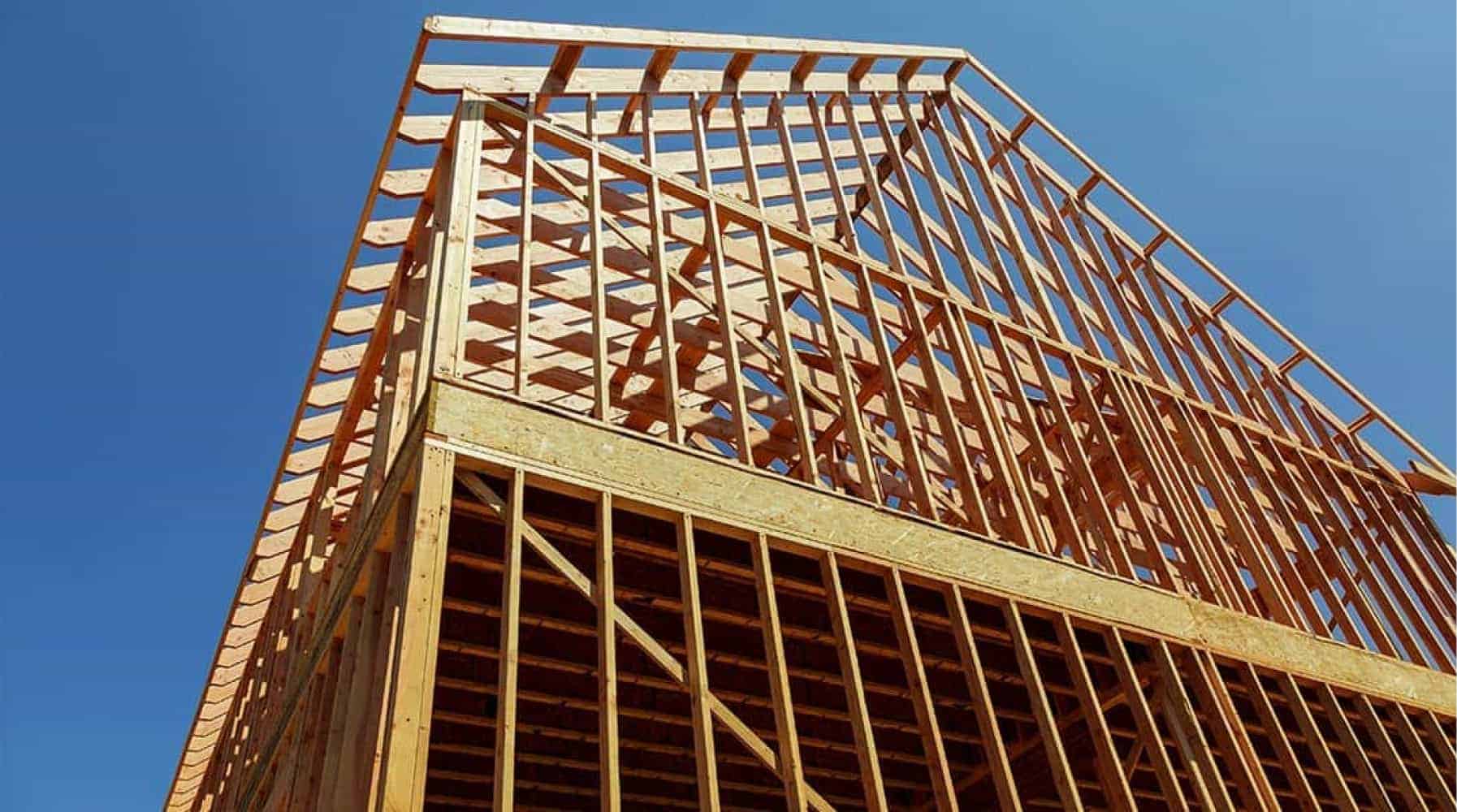

Latent Defects Insurance (LDI) protects against the costs of remedying damage resulting from a fault in the design or construction and only becomes apparent following completion of the project.

What is Latent Defects Insurance?

Latent Defects Insurance provides cover for the owner of a new property, should it suffer from damage caused by a defect in design, workmanship or materials used.

The term of the Latent Defects Insurance policy is typically 10 years but in some instances, 12 years can be achieved. Additional coverage can also include: loss of rent, cost of alternative accommodation and mechanical & electrical damage.

Cover is arranged by the developer or contractor and will be assigned to any future beneficiaries after the point of sale. It can be placed on new buildings, mixed tenures, significant extensions or conversions of existing buildings.

What is the benefit of Latent Defects Insurance?

Aids in the Selling Process

Building Defects Insurance can make selling a property much easier as it offers peace of mind to the purchasers.

Lower Repair Costs

The cost of repairs to fix a latent defect can be exorbitant. Having Building Defects Insurance will protect you against this kind of eventuality.

Required by lenders

Mortgage lenders insist on structural defects insurance before lending on any property under ten years old.

What are the benefits of choosing BuildSafe?

There are many benefits of choosing a provider like Buildsafe. Here are some examples:

Single Point of Contact

Our dedicated specialists will assist you through the entire process of, from filling in your paperwork to sourcing the most competitive product that is right for you.

Independent Advice

As an independent provider, our expert team can search the whole market for the best solution for your needs. All you have to do is fill in one form.

Best Value Guaranteed

Our experts ensure that you receive the best terms on any type of product we offer that suits your individual requirements.

Who should consider buying Latent Defects Insurance?

- Builders

- Developers

- Home-owners

- Lenders

- Housing associations

- Landlords

- Property owners

- Leaseholders

- Tenants.

BuildSafe Building Warranties

Latent defects can be extremely expensive to rectify.

In addition, trying to prove liability is not a straightforward process- this means that a claim could take years to reach a resolution.

Moreover, if the contractor is no longer in business when the defect becomes apparent, there may be little or no recourse for the owner.

BuildSafe is a client-led team of experts who take the stress out of searching for latent defects products by offering an independent, clear view on the market. Our Consultants specialise in finding bespoke solutions for your project needs and work to provide the best independent advice possible. We regularly work with developers on project values ranging from £200,000 to £100,000,000, and our team have a wealth of experience in all types of development projects.

Click here to get a quote or call us today on 020 3701 0422.

Get a Free Quote Today

Buildsafe are the UK’s leading specialist broker of Building Warranties and Construction Insurance. Get a free, no obligation quote from us online today!